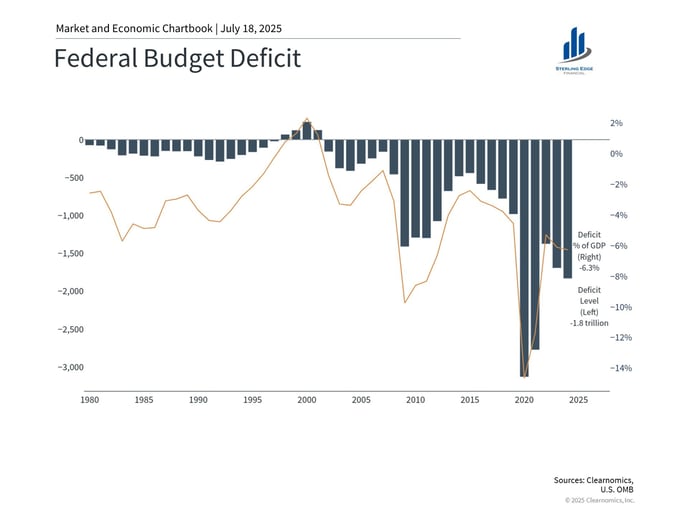

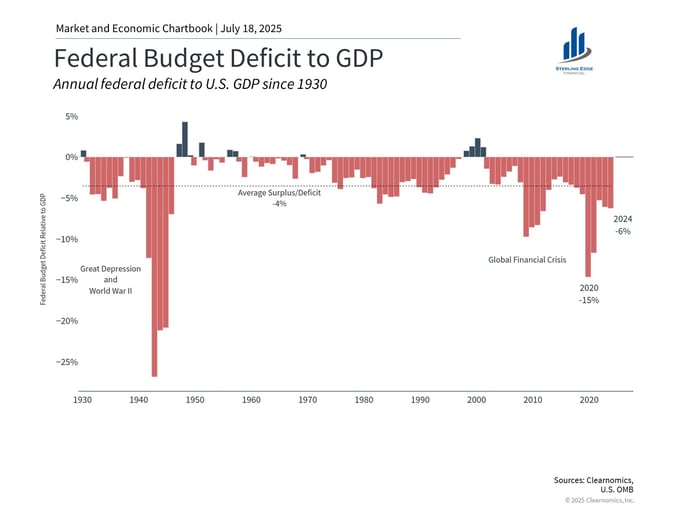

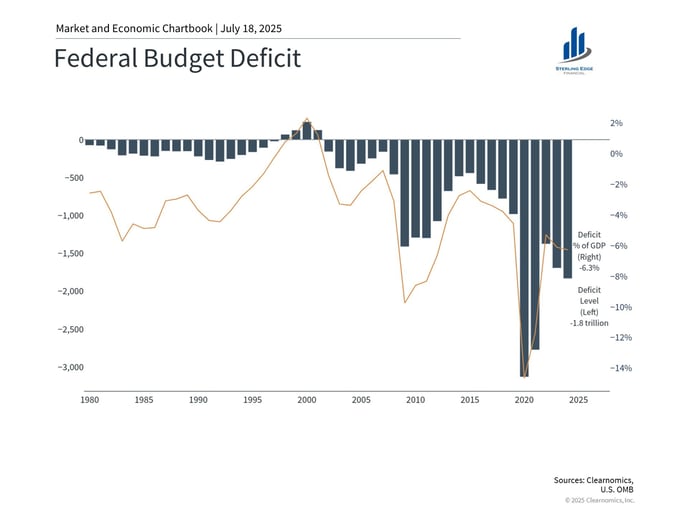

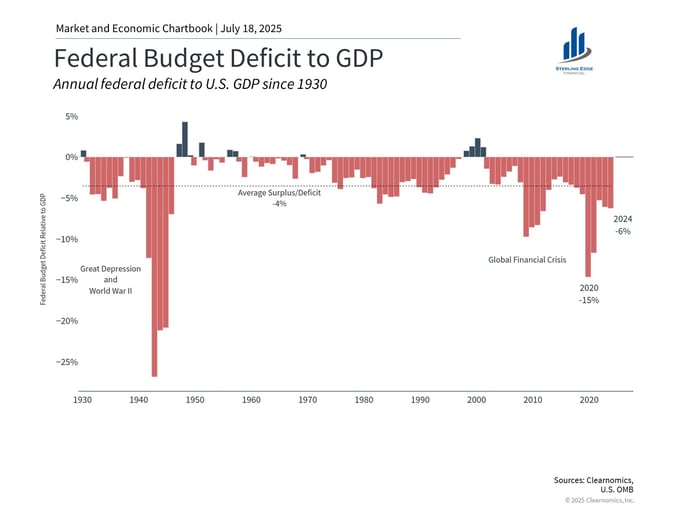

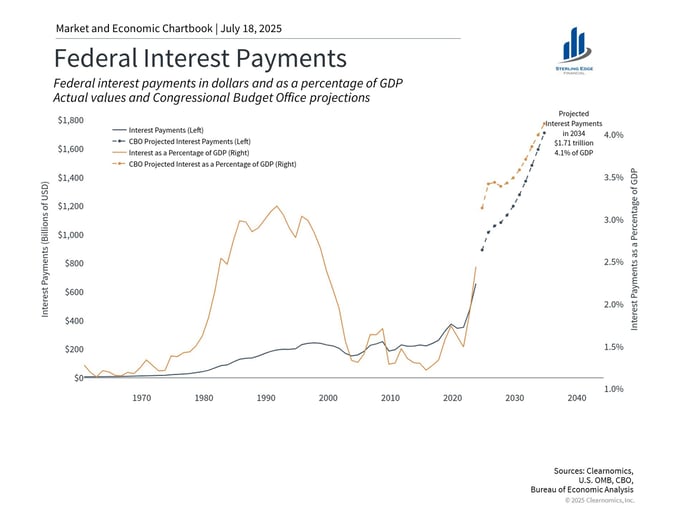

For over 25 years, the United States government has run budget deficits with startling consistency—in times of crisis and times of growth alike.

Bipartisan neglect has allowed unchecked government borrowing to become the status quo. Legislation like the recent "Big Beautiful Bill" has only entrenched this behavior, adding fuel to a federal spending fire that burns through trillions in debt with little regard for the consequences.

In the 1990s, fiscal responsibility was still a part of the political conversation. Both Democrats and Republicans made efforts to curb excessive spending. But that spirit seems long gone, buried under the weight of political division, culture wars, and an electorate numbed by easy credit. As we move through the summer of 2025, it's hard not to feel like we're quietly living through Cold War 2.0—as geopolitical tensions we refuse to name grow, we are too distracted by trivial debates and polarized talking points. Continued challenges from China and Russia will motivate increased military spending and global political risk.

If you're waiting for trickle-down economics to deliver long-term prosperity from this recent surge in federal largesse, prepare to be disappointed. The promise of value creation through massive spending, without meaningful reform or innovation, is a hollow one. It's time we prepare for a very different future—one where we can no longer afford to ignore the realities knocking at our door.

1. Rethinking Retirement: Social Security and Medicare Won't Be Enough

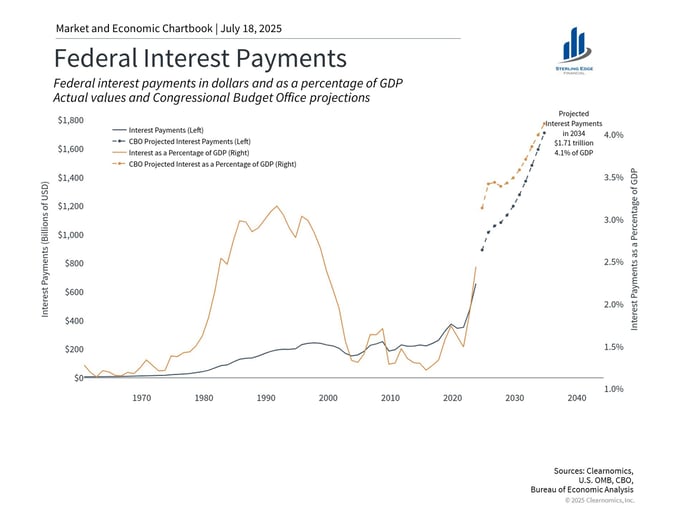

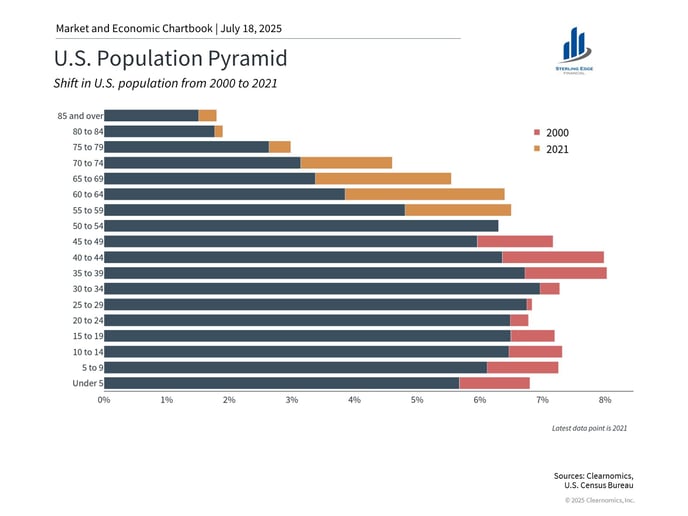

Social Security isn't going away—at least not anytime soon. But its future form may bear little resemblance to what today's retirees enjoy. I wouldn't be shocked if, within the next 10 years, full retirement age was pushed to 70 or beyond, and benefits cut by 5%, 10%, or even 20%. That's not paranoia; it's math. The trust fund is set to be depleted by the mid-2030s unless reforms are enacted.

Medicare, likewise, is facing a demographic time bomb. As fewer workers support a growing population of retirees, the financial burden becomes unsustainable. According to the Congressional Budget Office (CBO), Medicare spending totaled $829 billion in 2023 and is projected to surpass $1.7 trillion by 2033. The Hospital Insurance Trust Fund is expected to run dry by 2031 unless action is taken. We advise clients to plan as though meaningful Medicare access will be drastically reduced or delayed.

What does this mean for you? You need to be saving more—a lot more—for future medical expenses. If you're relying on the government to pick up the tab, you're gambling with your future.

.jpg?width=1366&height=768&name=Stock%20Images%20for%20Blogs%20(1).jpg)

2. The Education Reset: The End of Easy Student Loans

Higher education, once a ticket to upward mobility, is becoming an overpriced, overhyped product. The federal government is winding down support for subsidized student loans, and that means fewer options for families who can't self-finance.

Tuition costs have been artificially inflated by easy access to loans, and now that tap is drying up. The result? Fewer people will be able to afford traditional four-year degrees without taking on crippling debt. That might not be a bad thing.

To put it in perspective: In-state tuition and fees for the University of Wisconsin–Madison totaled approximately $11,216 for 2024, while the University of Illinois at Urbana-Champaign charged around $17,572. Multiply that by four years—before housing, books, and inflation.

Yet, despite the price tag, the lifetime earnings gap remains significant. According to Georgetown University’s Center on Education and the Workforce, bachelor’s degree holders earn $1.2 million more over a lifetime than those with only a high school diploma.

The next generation will have to rethink how they acquire skills—and how they measure value. Expect a shift toward practical credentials, bootcamps, certifications, and on-the-job learning. College will still matter, but it will no longer be the default path to success. Change is coming, and it won't be comfortable. But discomfort breeds innovation.

3. The Rural Health Crisis Is Accelerating

In the last decade, over 140 rural hospitals have closed across the United States, according to the University of North Carolina's Cecil G. Sheps Center. And the trend shows no sign of slowing. One stark example: Madera Community Hospital in California—a facility serving a community of about 50,000 residents—closed in 2023 due to insurmountable financial strain. The closure has left many without immediate access to emergency and inpatient care.

Access to care in rural communities is deteriorating, and unless you live in an affluent area or have premier private insurance, your options are shrinking. The implications for retirees and working families are profound. Expect longer wait times, fewer specialists, and increased pressure on already strained urban health systems. If you’re planning to retire away from major metros, make sure you understand what medical services will (and won’t) be available.

4. State Budgets Will Break

Many states—Florida, Texas, Kentucky, Mississippi, and West Virginia—lean heavily on federal funds, defense spending, and government services. According to the Pew Charitable Trusts and U.S. Bureau of Economic Analysis, federal spending accounts for over 20% of state GDP in these regions, with Mississippi and West Virginia exceeding 25%. If and when those federal dollars begin to dry up, they'll face a harsh choice: cut services or raise taxes.

I wouldn't be surprised to see income taxes implemented in traditionally no-tax states, or property taxes spike to unsustainable levels. We may also see more creative revenue tools: inheritance taxes, digital transaction levies, luxury consumption taxes. These may not be politically popular, but they're economically inevitable. Investors and residents in these states need to prepare for new tax realities.

5. Immigration: A Double-Edged Sword

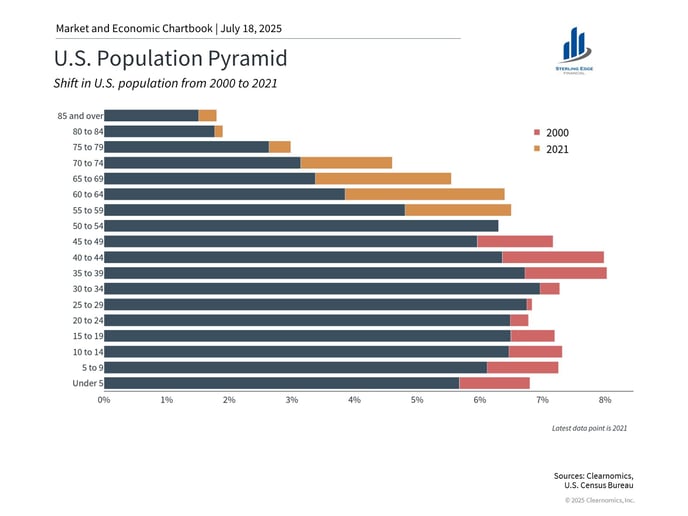

Immigration is one of the few levers the U.S. has to counter population decline—a crisis already hitting Europe and Japan. But political whiplash and rising enforcement are cutting off the very supply of labor we need to support growth. Restricting immigration doesn’t just hurt agriculture or construction; it starves the healthcare system, tech sector, and consumer demand. If we want a dynamic, prosperous economy, we need immigration. We need talent. And we need policies that reflect long-term goals, not short-term fear.

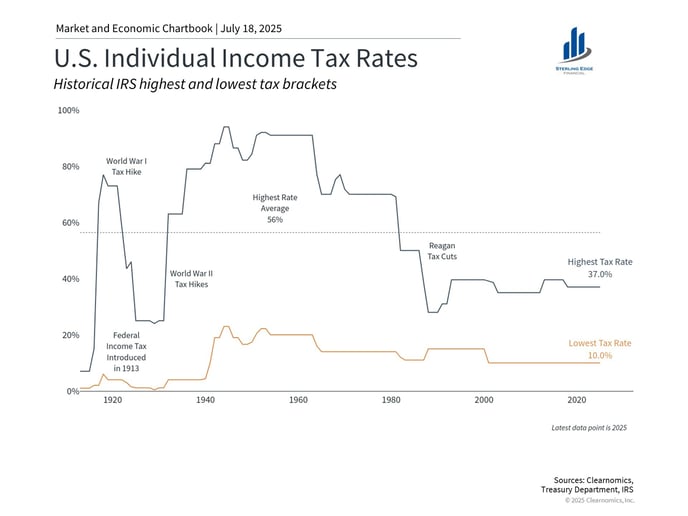

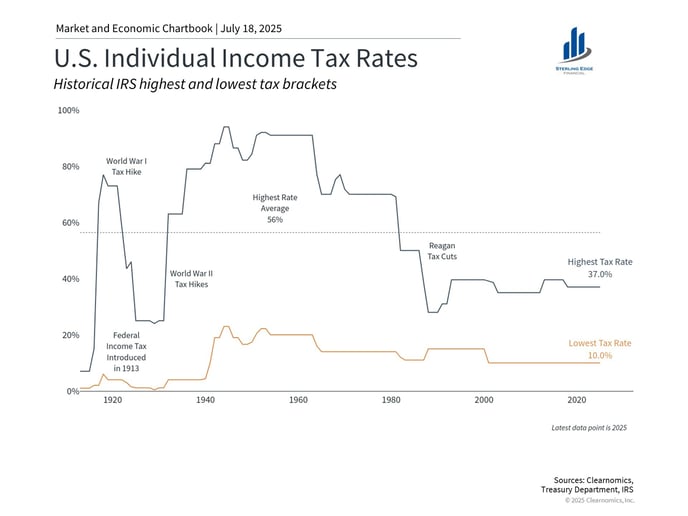

6. Taxes Will Go Up—But Not for Everyone

If you think taxes are high now, brace yourself. The U.S. tax system remains relatively generous compared to historical norms. But trillion-dollar deficits, ballooning debt, and increased spending will force a reckoning—primarily for high-income earners.

Here’s the reality: taxes are unlikely to increase significantly for billionaires or the ultra-wealthy. Through complex estate structures, private equity vehicles, deferred capital gains, and charitable loopholes, the ultra-rich often shield the majority of their wealth. Instead, the burden will fall on the upper-middle class and high earners—doctors, executives, business owners.

We need bold reformers willing to challenge this system, break up economic concentration, and reignite competitive capitalism. Until that happens, taxes will rise—on income, on investments, and on consumption. The smart investor prepares for this now.

7. Financial Advice: Beware the TikTok Experts

We live in a golden age of bad advice. Social media is filled with influencers peddling one-size-fits-all hacks that are, at best, unhelpful and, at worst, financially ruinous. The truth? Real financial success requires real investment: in planning, expertise, discipline, and execution. You wouldn't run a marathon without a coach, a plan, and years of preparation. Why would you approach your financial life any differently?

At Sterling Edge Financial, we work with clients who understand this. They’re not looking for magic tricks. They’re looking for clarity, confidence, and a real strategy tailored to their lives.

.jpg?width=760&height=427&name=Blog%20End%20Caps%20(2).jpg)

.jpg?width=1366&height=768&name=Stock%20Images%20for%20Blogs%20(1).jpg)

.jpg?width=760&height=427&name=Blog%20End%20Caps%20(2).jpg)