Bear Markets, Sell Offs and Reflecting on Asset Allocation – April 2025

How you handle a market sell off. Revisiting your financial plan and investment policy statement.

We’re entering a turbulent time in the markets. Seeing negative returns on your statement isn’t just unsettling—it triggers the same fight-or-flight response in our brain as physical danger. Studies show that losses feel 2 to 3 times more painful than gains feel rewarding. That’s why a 20% drop feels devastating while a 20% gain feels only moderately satisfying.

It’s natural to feel this way. But reacting emotionally to investment pain often leads to poor financial decisions. Before making changes to your portfolio, it’s critical to revisit your financial plan and asset allocation strategy.

Market Downturns = Opportunity for Long-Term Investors

If you’re in the accumulation phase—saving and building wealth—market sell offs can actually work in your favor. Lower prices mean buying opportunities. While some companies will falter or fail, others are temporarily undervalued and poised for long-term growth. This is where global diversification can create value.

Concentrated portfolios can be permanently damaged when a single company or sector fails. A diversified portfolio, on the other hand, spreads risk across many asset classes and geographies—offering less volatility / more stability.

If you are in the deaccumulation phase, downturns can feel especially painful. It is more important than ever to not panic. If you are feeling panic, book time to talk to us ASAP. We are in this with you.

Below are three charts and three examples to help us remember why at Sterling Edge Financial we build, recommend and implement portfolios for our clients that are globally diversified. Taking into account a number of asset classes including: stocks, bonds, alternative investments, private placements and annuities. While diversification does not guarantee returns, it does help us manage investment risk.

Understanding Investment Risk Over Time

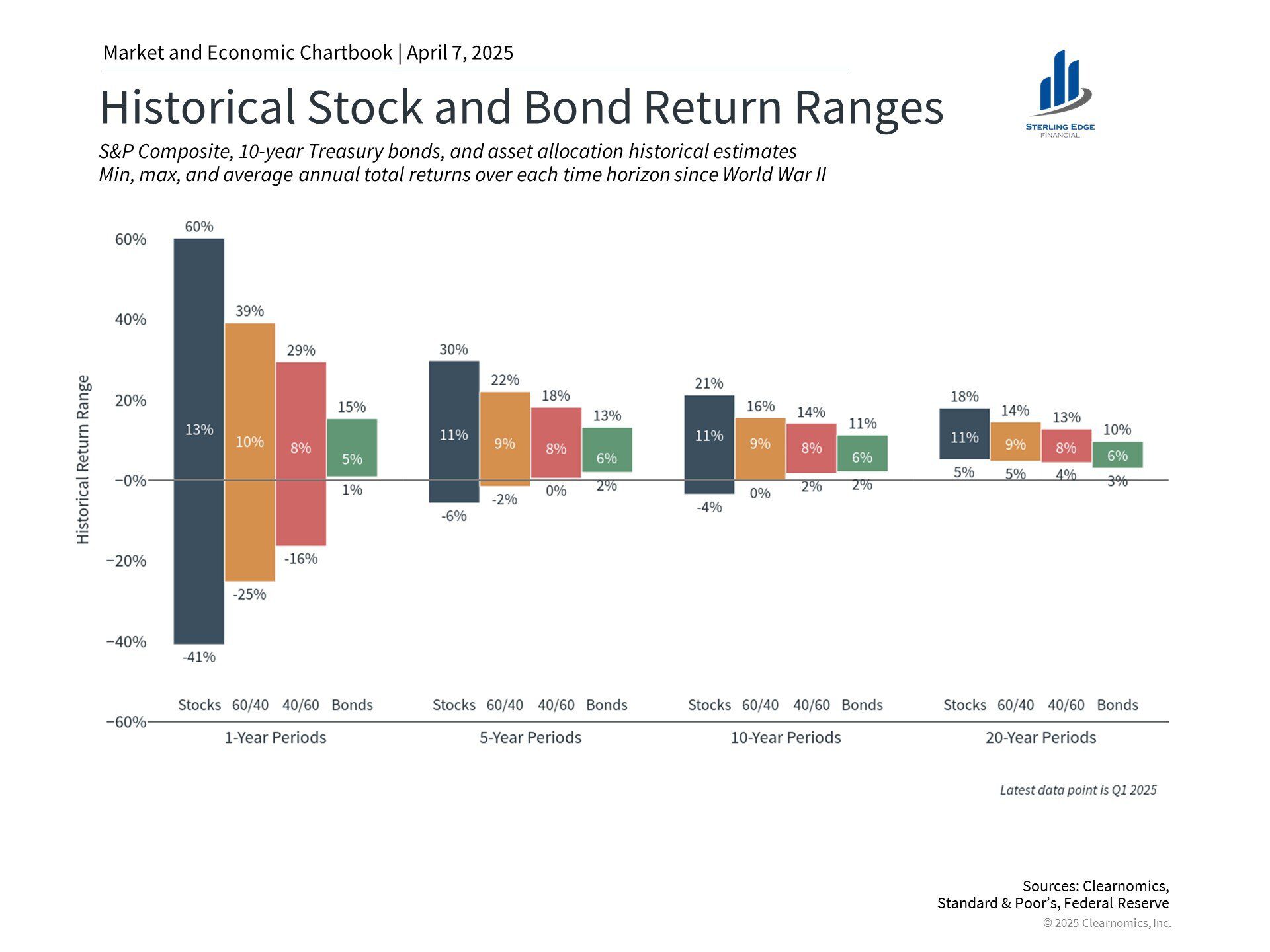

Refer to Chart 1: Historical Stock and Bond Return Ranges

This chart shows minimum, maximum, and average returns for stocks, bonds, and blended portfolios over different timeframes—from 1 to 20 years—since World War II.

Key Insights:

-

Short-Term Volatility Is Normal: In any given year, stocks have returned anywhere from +60% to -41%. Bonds 1% to 15%

-

Risk Smooths Out Over Time: Over 10- and 20-year periods, the range of returns tightens considerably.

-

Diversification has Worked: 60/40 portfolios (60% stocks, 40% bonds) show reduced downside while capturing meaningful upside. While this isn’t guaranteed, it is likely to repeat itself in the future.

Investing takes time. I will often say investments do not make money all the time, however they tend to make money over time. If you look at any one asset class, the returns tend to be lumpy. The longer you stay invested, the more chance you have to benefit from compounding.

Having adequate cash reserves and income sources allows you to leave investments untouched during downturns, minimizing the impact of losses. This chart is one of many reasons you will hear us ask about and model your cash flows over the next 5 years. Money needed in the next 5 years will generally be best placed in cash, high yield FDIC insured savings accounts and short term investment grade bonds.

The Power of Diversification Through Crisis

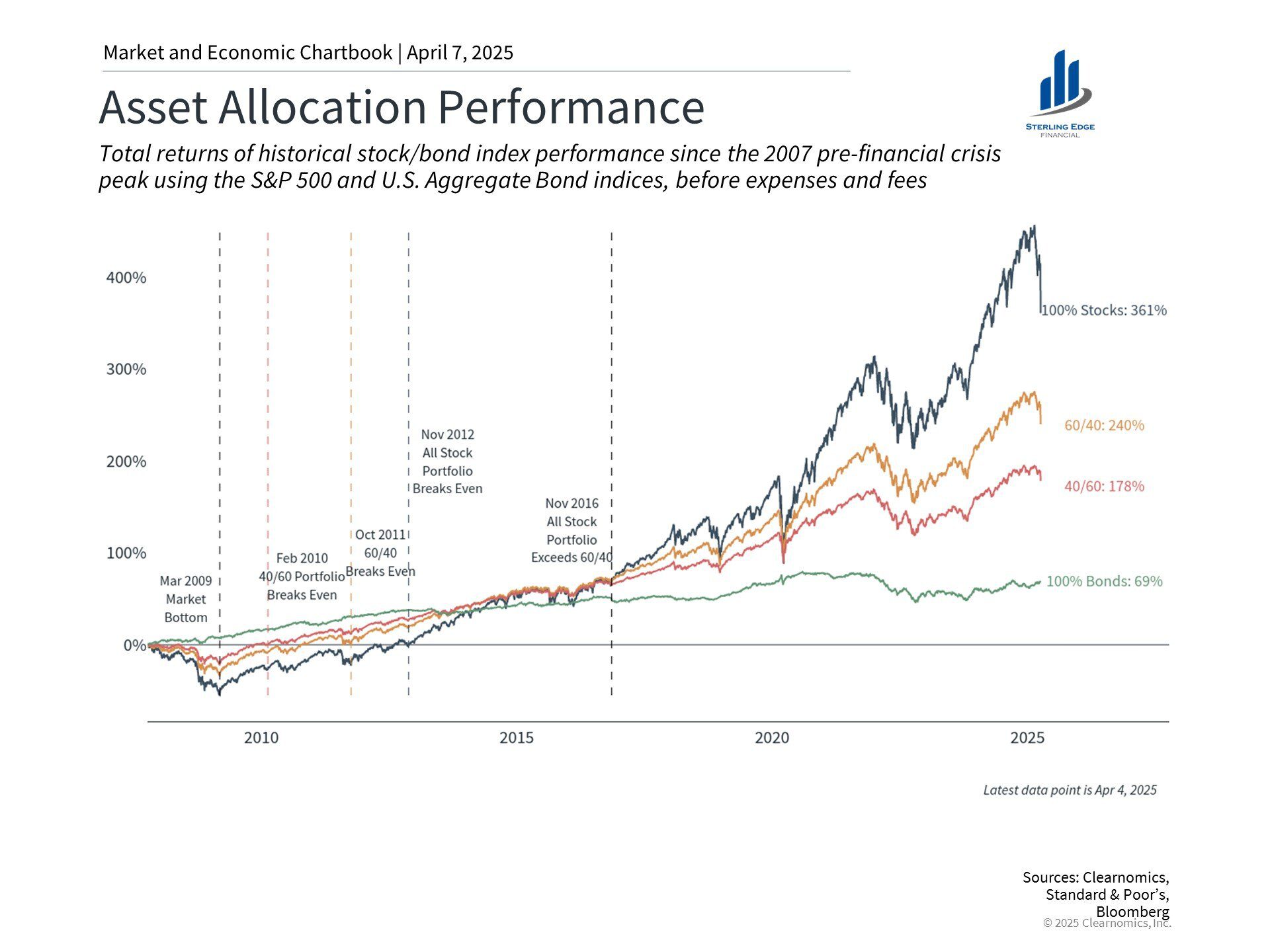

Refer to Chart 2: Asset Allocation Performance (2007–2025)

This timeline shows how stock, bond and diversified portfolios performed before, during, and after the 2008 financial crisis.

Notable Takeaways:

-

The S&P 500 took over 3 years to recover from its 2009 low.

-

A 100% stock portfolio took nearly 7 years to surpass the recovery of a 60/40 portfolio.

-

Bonds acted as a shock absorber, helping mixed portfolios recover faster.

No two downturns are the same. But this chart is a reminder that diversification may provide principal protection and reduce recovery time. Being 100% invested in stock will explosure your portfolio to investment risks that could result in negative returns or underperform fixed income or diversified portfolios for several years.

Why Chasing Past Performance Is a Losing Strategy

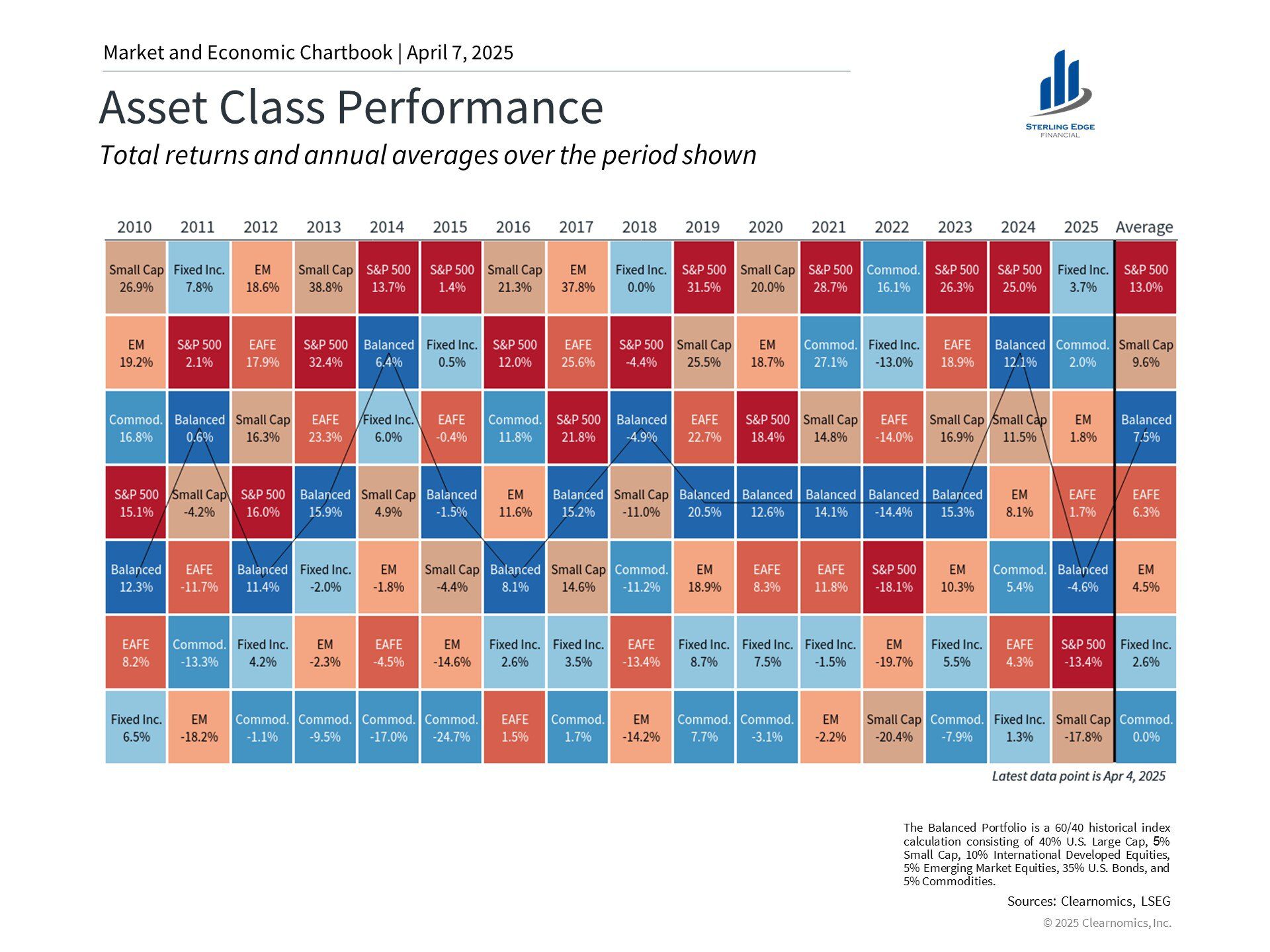

Refer to Chart 3: Asset Class Performance Since 2010

Each year, a different asset class leads the pack. One year it’s commodities, the next it’s small caps or emerging markets. Our brains are wired to see patterns or want to see patterns—but in investing, those patterns rarely repeat, nor is there any math / research to show or justify searching for patterns.

Important Lessons:

-

Returns are highly unpredictable year to year.

-

Overweighting “last year’s winner” is more gambling than investing.

-

A balanced portfolio may provide more consistent, less volatile returns. (see Modern Portfolio Theory)

From a planning perspective, a diversified strategy may limit some upside, but it also tends to reduce the risk of catastrophic loss—a tradeoff most retirees or long-term investors should welcome.

Looking Ahead with Discipline and Perspective

2025 is shaping up to be a difficult year. Trade wars and market shocks will test your resolve. But remember:

-

We are never entitled to gains—investing involves risk.

-

Negative returns are normal, and sometimes necessary, to earn positive long-term returns.

-

Your goals require time, discipline, and the right strategy—not short-term gains.

You didn’t invest to win today or tomorrow. You invested to meet long-term goals. You understand and know this is a long game.

Let’s Revisit Your Risk and Strategy

2025 is shaping up to be a difficult year. Trade wars and market shocks will test your resolve. But remember:

-

We are never entitled to gains—investing involves risk.

-

Negative returns are normal, and sometimes necessary, to earn positive long-term returns.

-

Your goals require time, discipline, and the right strategy—not short-term gains.

You didn’t invest to win today or tomorrow. You invested to meet long-term goals. You understand and know this is a long game.

Let’s Revisit Your Risk and Strategy

As a client of Sterling Edge Financial, you have access to your personalized Riskalyze Report in your eMoney Vault. This tool helps ensure your portfolio aligns with your goals and tolerance for risk.

If you’d like to review or update your portfolio or Riskalyze Report—or if someone you care about needs guidance—please don’t hesitate to schedule time with us.

Stay invested. Stay diversified. Stay focused.

Kit Lancaster, CFP®, AWMA®

President

Book a Meeting with Kit Lancaster CFP

Book a Meeting with Katie Sauer

This content is being provided for informational purposes only and should not be construed as specific recommendations or investment advice. Always consult with your investment professional before making important investment decisions. Diversification and asset allocation strategies do not assure profit or protect against loss. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including total loss of principal.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Sterling Edge Financial LLC. are not affiliated.

Copyright 2025 Sterling Edge Financial