Applying Poker Lessons to Investing

Poker is often thought of as a game of skill, luck, and strategy. However, beyond the chips and cards, poker also offers profound insights into human psychology and decision-making. Blind spots are systematic deviations from rational decision-making that affect how people perceive and react to information. Poker, with its blend of incomplete information, risk, and competition, exposes these biases in ways that can be difficult to see in everyday life. From self-attribution to the outcome bias, poker helps us understand these cognitive pitfalls, offering valuable lessons for both players and non-players alike.

In this article, we explore how poker reveals some of the most common behavioral biases and what they teach us about human decision-making.

Outcome bias:

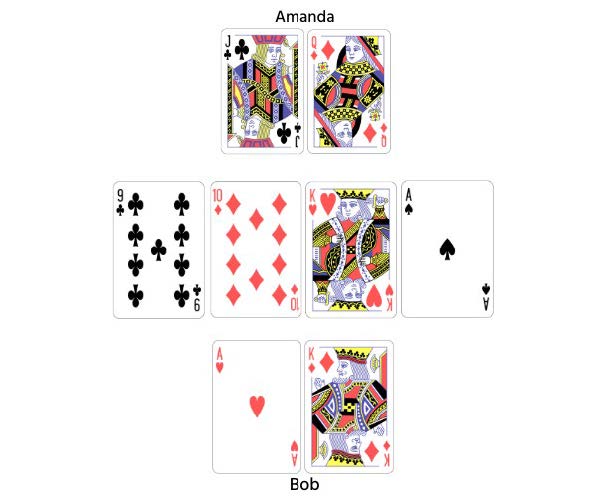

Imagine that Bob and Amanda are playing poker. Bob has an Ace (A) and King (K) in his hand. Amanda has a Queen (Q) and Jack (J). The cards on the table are Nine (9), Ten (10), King (K) and Ace (A). Both players decide to go all-in.

A Queen appears on the river to complete a straight (9-10-J-Q-K) for Amanda, which beats Bob’s two pairs. Was Amanda’s decision the right one? With outcome bias, people think that Amanda’s decision to go all-in was great because she ended up winning, even though she had only about 4.5% chance of winning before the Queen appeared on the river. Had Amanda lost, they would have concluded that the same decision to go all-in was reckless.

Poker teaches us not to judge the quality of a decision only based on the outcome. Because of luck, the right decision may lead to a bad outcome, or a risky decision may turn out good. Another benefit of poker is that it involves many hands within each game, allowing players to quickly see how decisions play out. By contrast, it may take months or years to know if a decision was good in real life, because the outcome does not occur immediately. Outcome bias can also affect financial decisions. For example, an investor may thoroughly research and invest in a stable company with strong fundamentals, only for an unforeseen event to cause the stock to plummet. Due to outcome bias, the investor might view this as a poor decision, even though the decision-making process was sound.

Loss aversion and self-control:

Loss aversion is the tendency to feel the pain of losses more deeply than the pleasure of financial gains. In poker, knowing when to fold and realize your loss is one of the hardest skills to acquire. Most beginner players usually keep adding chips to a pot despite holding a weak hand, simply because they’ve already put money in. They may continue to chase an unlikely outcome, unwilling to fold and lose their earlier investment. With loss aversion, the decision to fold becomes more difficult as a player keeps adding money to the pot and the potential loss feels more significant.

Poker inherently rewards patience and long-term thinking. It requires resisting the urge to act impulsively, and sometimes folding dozens of hands before receiving a favorable one. When making financial decisions, loss aversion causes investors to hold on to their losing stocks for too long because they are reluctant to sell them and realize a loss.

Self-attribution:

When a player wins a hand, they may feel that their victory was due to superior strategy or skill, even if luck played a major role. Conversely, when they lose, they may dismiss the result as an unfortunate stroke of luck rather than examining potential mistakes in their play. With self-attribution blind spot, players attribute their successes to their own skill, while blaming failures on external factors like “bad luck”, “poor card deals”, or – ironically – other players’ luck. Over time, this bias can reinforce poor habits by preventing players from learning from mistakes. In real life, an investor might undervalue the importance of a financial advisor by attributing gains to their own wisdom instead of their advisor’s advice.

Conclusion

Poker is a microcosm of human behavior, offering insights into the psychological biases that influence decision-making. Recognizing these biases in the heat of the game helps players make more rational decisions. The lessons from poker apply broadly to areas like investing, business, and personal development. Ultimately, poker teaches us that success requires self-awareness, emotional regulation, patience and the ability to think objectively in the face of uncertainty.